Summary

- What is customer dunning?

- What mistakes should you avoid when following up with clients?

- How to manage client follow-ups: What tools should you use?

- Examples of Customer Dunning Software

- Advantages of Customer Dunning Software

- What Is the Right Timing to Follow Up with Clients?

- 6 Examples of Customer Dunning

- What to Remember About Customer Dunning

- Customer Dunning FAQ

Client dunning is crucial for maintaining an enterprise's cash flow. Given that some clients may be reluctant to pay invoices on time, establishing an effective and customised follow-up strategy becomes essential.

Try Ringover For Free!

This guide explores the mistakes to avoid during client follow-ups, introduces key tools for successful collection strategies, and provides examples of respectful and effective follow-up techniques.

What is customer dunning?

Customer dunning is the action of repetitively and reasonably contacting a customer to collect accounts receivable. It's part of a receivables management process designed to encourage prompt payment while maintaining a professional relationship.

Reminders can be made by various means, such as phone, email or post, and must be adapted to the context of each customer. They are an essential lever for improving a company's cash flow, while avoiding late payment or litigation.

What mistakes should you avoid when following up with clients?

Some common practices can be counterproductive, reducing the effectiveness of your efforts and potentially damaging business relationships. Let's identify the most common mistakes to avoid:

Mistake #1: Applying the same follow-up process to all clients

A common error is using a one-size-fits-all approach for all clients. However, each client has unique needs and expectations. It's essential to tailor the frequency, tone, and communication methods based on each client's profile.

For example, if a client doesn't respond to emails, a phone call follow-up might be more effective. For key accounts, a more nuanced approach is required to avoid jeopardising the business relationship.

Mistake #2: Waiting until the due date to follow up

Only following up with a client on the invoice due date is a practice to avoid. Implementing a pre-reminder phase a few days before the due date can encourage timely payment while maintaining a positive relationship with the client.

Mistake #3: Not assessing your client at the start of the relationship

Failing to analyse a client's financial and commercial profile at the beginning of the relationship can complicate future collection efforts. Understanding your client's profile allows you to adjust your follow-ups and offer tailored solutions for unpaid invoices.

Mistake #4: Relying on a single follow-up channel

Limiting your follow-ups to a single communication method (email, letter, phone call) reduces your chances of success. It's recommended to diversify omnichannel communication channels to optimise the chances of receiving a response from your clients.

Mistake #5: Stopping communication after payment is made

It's advised to continue communication even after payment is made. This helps maintain a positive brand image and shows that the company cares about the client beyond financial transactions. It also fosters a healthy and open dialogue, even on sensitive issues.

Ease the customer dunning process by deploying a VoIP phone software like Ringover, which provides multichannel communications far beyond unlimited phone calls.

How to manage client follow-ups: What tools should you use?

To effectively manage client follow-ups, it's essential to use tools that streamline the collection process and minimise payment delays. Below is a selection of tools that can improve the management of your client follow-ups.

Software for debt recovery

Debt recovery software is designed to automate and simplify client follow-up processes. These tools offer a range of features to track and manage unpaid invoices efficiently. Key features include:

- Debt tracking

- Integration with ERP or accounting systems

- Dispute management

- Client communication

For collection teams, omnichannel contact centre software like Ringover is an invaluable ally in managing client follow-ups. Let's take an example of a company dealing with a portfolio of unpaid invoices. Collection teams often face complex situations where a clear, quick view of client communications is crucial.

For instance, when a collection agent calls a client about an overdue invoice, they can refer to the previous call logs and call recordings via Ringover, which connects directly to their business software, including CRMs like Hubspot, Salesforce, and customer service solutions like Zendesk.

Let's assume a client had already promised to pay by a specific date but missed the deadline. Thanks to the tool, the agent can quickly retrieve this exchange and remind the client of their commitment, making the follow-up more precise and effective.

Moreover, multiple team members may interact with the same client in some cases. A tool like Ringover allows all agents to access the complete history of past interactions, whether through unlimited calls, text messages, or emails. This prevents duplicate follow-ups and ensures consistent, coordinated tracking.

Another concrete example is the use of features such as call recording, summaries, and automatic transcription. Suppose a client disputes an amount due or the terms of a past discussion. The team can retrieve the entire conversation in audio, written, or summary format, identify any misunderstandings, and rely on specific facts to resolve the situation.

This enhances the team's transparency and credibility. Additionally, all of this data can be used for legal purposes if necessary.

Finally, with features such as sending automatic reminders via text message or voicemail, Ringover can ease the workload of the team. For example, a message can be automatically sent to each client when the due date is approaching or has just passed. This helps reduce the number of manual follow-ups needed and allows more time to be spent on more complex cases.

In summary, such a communication solution not only facilitates calls but also enables a smoother, well-documented, and proactive management of client follow-ups, which is essential for the success of financial teams.

Examples of Customer Dunning Software

Here are a few recovery software options that can transform the management of your client follow-ups:

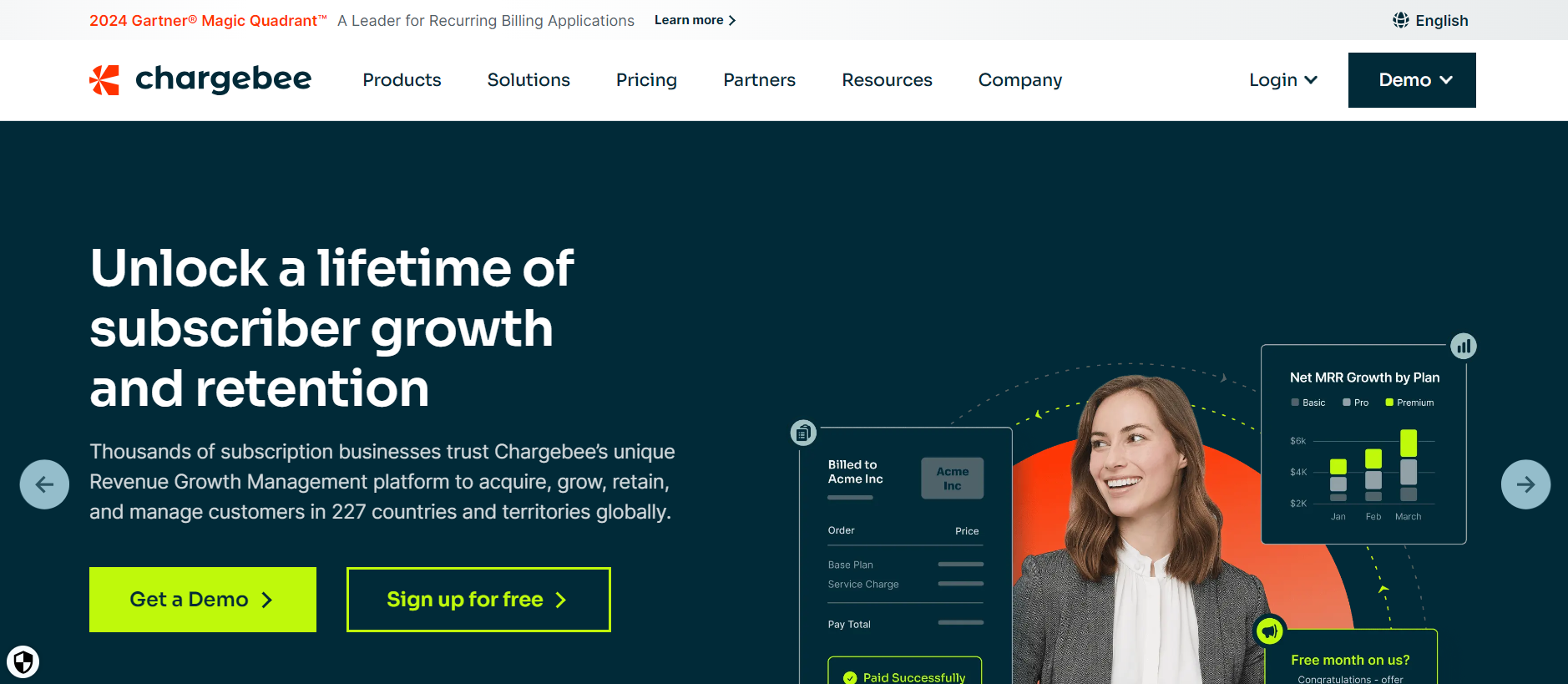

1. Chargebee

Chargebee is a subscription management platform that automates recurring billing, invoicing, and dunning processes. It is designed to handle subscription-based businesses by managing customer payments, ensuring timely notifications, and automating the follow-up process for failed payments.

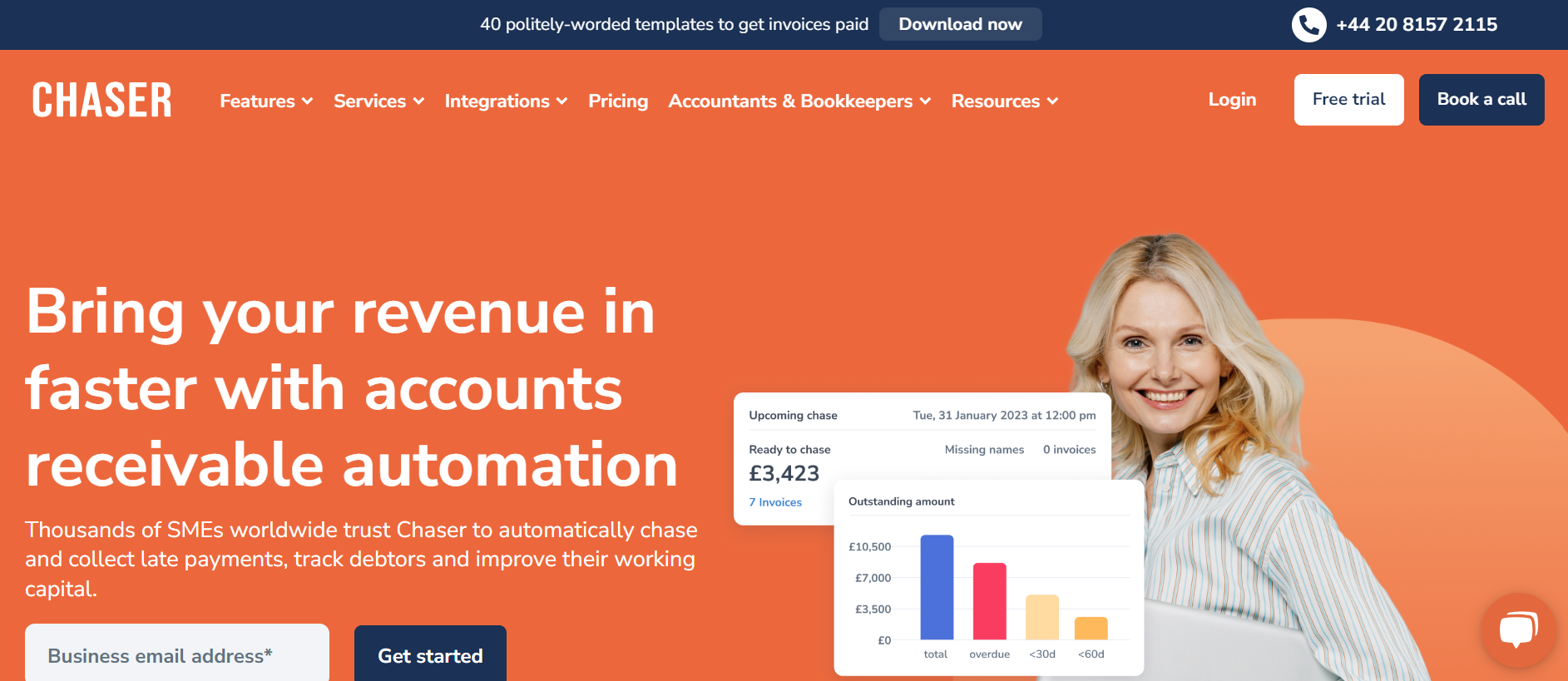

2. Chaser

Chaser is a UK-based cloud software focused on accounts receivable and automating customer dunning communications. Chaser allows businesses to send customised email reminders for overdue payments, reducing the manual effort of chasing invoices while improving cash flow.

3. YayPay

YayPay is a cloud-based accounts receivable automation tool that focuses on streamlining the collections process. With its powerful dunning capabilities, YayPay automatically sends reminders to customers, reducing the chances of payment delays. Differentiating Factors:

4. GoCardless

GoCardless is a popular payment solution for businesses of all sizes, offering automated direct debit services. It simplifies the collection of recurring payments and handles failed payments with an automated dunning process.

Advantages of Customer Dunning Software

The use of these software tools offers numerous benefits, such as reducing payment delays, automating follow-up processes, and enabling effective collaborative management. They also contribute to a reduction in costs and significant time savings in the recovery process.

By integrating these tools into your strategy, you'll optimise client follow-up management, improve cash flow, and maintain excellent client relationships.

How to Politely Follow Up via Email?

Following up with a client via email requires tact and caution to avoid coming across as too insistent or aggressive. Here are some tips for crafting a polite yet persuasive follow-up email:

1. Create a catchy and relevant subject line

The subject line of your email is crucial to encourage the recipient to open it. It should be concise, relevant, and create a sense of interest or urgency without overdoing it. For example: "Follow-up regarding your invoice from March 15" or "Final reminder before due date: Invoice No. XXXX".

2. Personalise your email

Address the recipient by name and refer to previous interactions. This personalization encourages the recipient to open and respond to your email.

3. Be concise and clear

A follow-up email should be direct and structured. Stick to the essentials and organise your message clearly. Briefly introduce the context before stating your request.

4. Adopt a courteous and professional tone

Start with a respectful greeting and conclude by inviting the recipient to further discussion. The tone should be tailored to the recipient, ensuring a courteous, professional approach.

5. Offer an alternative or solution

When requesting an appointment or specific action, offer alternative dates or solutions, demonstrating flexibility. This could include suggestions for virtual or phone meetings.

6. Be patient and respectful

Allow a few days between follow-ups to give the recipient time to respond to your initial request.

What Is the Right Timing to Follow Up with Clients?

Optimising the timing of your client follow-ups is key to speeding up recovery and maintaining excellent business relationships. Here are the key principles for identifying the right moments to follow up.

Pre-due date Follow-Up

It's recommended to contact clients before the invoice due date to prevent late payments. Including a reminder step in your follow-up process a few days before the due date can be very effective. This approach helps minimise late payments and reinforces communication with clients.

Post-due-date Follow-Up

In case of non-payment by the due date, it's essential to follow up promptly. A first reminder can be sent the day after the due date, with additional follow-ups spaced out by a few days if necessary. For example, the first follow-up email could be sent seven to 15 days after the due date, followed by a second reminder if no response is received.

Adapting to the Client Profile

Follow-up timing should be personalised according to the client profile. High-risk clients or key accounts may require a more tailored strategy with specific follow-up intervals.

Automating Follow-Up

Automating follow-ups can save time for your teams and streamline the process. Recovery management software allows follow-up reminders to be scheduled at precise times, ensuring that actions are taken at the right moment.

6 Examples of Customer Dunning

Here are three examples of reminder emails you can use depending on your sector.

Example 1: B2C Customer Reminder in the Tourism Sector

A warm, personalised approach is essential in the tourism sector to maintain good customer relations. Here's a reminder email designed for this sector:

Subject: Payment Reminder - Reservation n°XXXX

Hello [Customer Name],

We would like to remind you that payment for your reservation n°XXXX, for an amount of [amount], is overdue. We are aware that unforeseen circumstances may arise and are willing to consider a payment plan that suits you.

We value your loyalty and want to continue to provide you with exceptional travel experiences. Please contact us as soon as possible to rectify your situation.

Yours,

[Your Name] [Your Position] [Your Company] [Contact Details]

Example 2: B2C Customer Reminder in the Insurance Sector

In this sector, professional and informative communication is needed to highlight the consequences of late payment. Here's an example of a suitable reminder email:

Subject: Payment Reminder - Insurance Policy n°XXXX

Hello [Customer Name],

We would like to inform you that payment of your insurance policy n°XXXX, in the amount of [amount], is overdue. It is essential that you regularise this situation as soon as possible to avoid an interruption in your coverage.

We invite you to contact us as soon as possible to discuss a payment plan that suits your situation. We will be happy to answer any questions you may have and help you maintain your coverage.

Yours,

[Your Name] [Your Position] [Your Company] [Contact Details]

These examples illustrate the importance of adjusting the tone and content of customer follow-ups depending on the sector, to increase their effectiveness while preserving business relationships.

Example 3: B2C Reminders in the Energy Sector

The energy sector, with its specific regulations and financial aid, requires a tailor-made approach. Here's an example of a reminder email for this sector. These are, of course, generic examples, but they must be customised to suit each specific situation:

Subject: Payment Reminder - Invoice n°XXXX

Hello [Customer Name],

We would like to remind you that your invoice n°XXXX, amounting to [amount], is overdue. In view of the regulations in force, [example of regulation: the winter truce], we cannot interrupt your gas and electricity supply during this period.

We are aware of possible financial difficulties and are open to discussing a suitable payment plan. Please contact us as soon as possible to find a solution.

Yours,

[Your Name] [Your Position] [Your Company] [Contact Details]

Example 4: B2B Customer Reminder in the Energy Sector

In the energy sector, late payment can lead to supply interruptions or contractual penalties. Communication needs to be clear and focused on continuity of service.

Subject: Payment reminder - Supply Contract n°XXXX

Hello [Customer Name],

We would like to remind you that your invoice n°XXXX, for an amount of [amount], relating to your energy supply contract, is overdue. In order to avoid any interruption of service, we invite you to regularise this invoice as soon as possible.

If you are experiencing financial or organisational difficulties, we would be happy to discuss a suitable solution, such as an instalment plan.

We are counting on your responsiveness to avoid any inconvenience, and remain at your disposal for any questions you may have.

Yours,

[Your Name] [Your Position] [Your Company] [Contact Details]

Example 5: B2B Recovery in the Technology Services Sector

In this sector, late payments can affect licence renewals or access to essential services. Communication focused on service continuity is crucial.

Subject: Payment Reminder - Service n°XXXX

Hello [Customer Name],

We would like to remind you that the invoice for service n°XXXX, in the amount of [amount], is overdue. In order to avoid any interruption of access to your technological solutions, we invite you to proceed with payment as soon as possible.

We remain at your disposal to discuss possible payment terms adapted to your situation.

Please contact us as soon as possible to resolve this situation and ensure continuity of your services.

Yours,

[Your Name] [Your Position] [Your Company] [Contact Details]

Example 6: B2B relaunch in the construction industry

In the construction industry, late payments can cause delays in ongoing projects. In this case, a reminder of the importance of keeping work on schedule is appropriate.

Subject: Payment reminder - Project n°XXXX

Hello [Customer Name],

We are writing to you regarding invoice n°XXXX, amounting to [amount], which remains unpaid to date. In order to avoid any delay in the progress of your work or in the supply of materials, we invite you to regularise this payment as soon as possible.

Should you encounter any difficulties, we would be happy to discuss a mutually acceptable arrangement to ensure the successful completion of your project.

We thank you for your cooperation and remain at your disposal should you have any questions.

Yours,

[Your Name] [Your Position] [Your Company] [Contact Details]

What to Remember About Customer Dunning

In conclusion, customer dunning is vital to ensuring healthy cash flow and lasting business relationships. It's essential to personalise your approach, avoid common mistakes and select the right tools to automate and refine this process.

Choosing the right moments to follow-up and adapting communication channels to the specific profile of each customer is also important.

By adopting these strategies and implementing effective client dunning methods, you can turn late payments into opportunities to consolidate your business relationships.

Don't hesitate to take action by developing a customised dunning strategy that meets your requirements, to improve your collection efficiency and protect your cash flow.

Customer Dunning FAQ

How do you execute customer dunning without antagonising them?

The key to raising a customer's voice without antagonising them is to adopt an empathetic, professional approach. It's important to remain courteous and to present the reminder as a simple reminder. Here are a few tips:

- Personalise the message: Show that you know the customer's situation, by mentioning the invoice or services concerned, and taking into account their payment history.

- Be clear but conciliatory: Explain the situation precisely, but leave an opening for discussion, for example by proposing a suitable payment plan if the customer is experiencing difficulties.

- Remain positive: Reinforce the value of the relationship by reminding them of the importance of the partnership or the quality of the services provided. The aim is to find a solution together, not to put the customer on the defensive.

What to say when a customer doesn't respond?

If a customer doesn't respond after several reminders, it's essential to adapt the tone and content of your message. Here are some elements to include:

- Reinforce urgency: Remind them of the consequences of non-payment, such as penalties or suspension of services, while remaining respectful.

- Multiply channels: If your emails go unanswered, try to reach the customer by telephone or other means of communication.

- A phone call can sometimes unblock a situation.

- Propose an alternative: Mention the possibility of discussing an amicable solution (payment by instalments, deferment). This shows your willingness to compromise.

Published on October 7, 2024.